Private Equity

Chafia Capital Partners invests in businesses at various stages, including startups, which Chafia has both developed in house and provided seed capital & advisory services

Overview and Philosophy

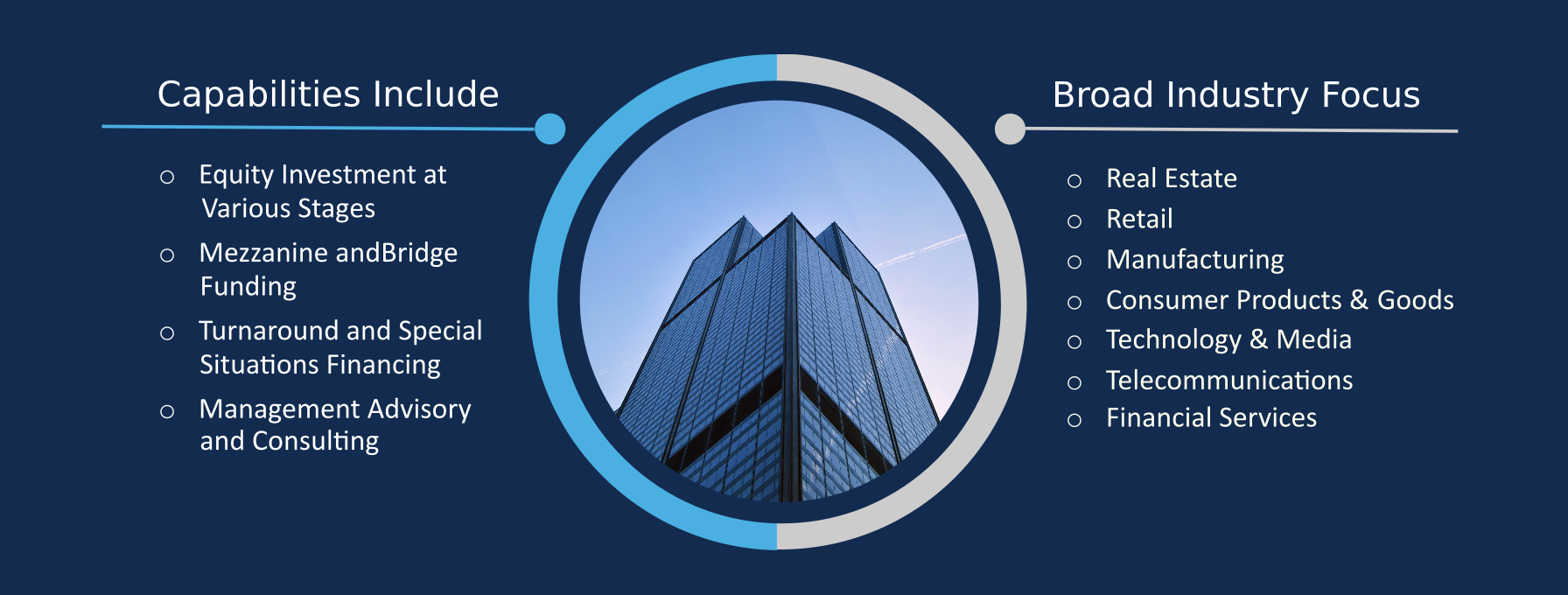

Chafia Capital Partners has a flexible investment criterion which allows the firm to take on a variety of projects. Chafia has experience starting and growing small businesses, providing the support, guidance, and resources necessary to succeed. Examples of value created by Chafia include enhancing business development by creating new sales opportunities, implementing systems to measure against specific strategic goals, and deploying targeted capital and high return projects.

Chafia Capital Partners will also finance and seed technology companies as a venture capital investor and is willing to provide its advisory platform to help a growing business optimize its financial position and competitive strategy. Chafia will work and partner with management teams and help better position businesses for future growth at various stages. Appropriate forms of financing across the capital structure will be considered. Each investment has an immediate actionable development strategy guiding improvements and value creation.

The team at Chafia Capital Partners have led venture investments to multiple successful exits and buyouts. In addition to nurturing venture capital portfolio companies, our members have significant experience starting companies of their own. Several companies at various stages are part of Chafia's portfolio.